Money Energy: a personal history, a necessary future

Though I now see money energy everywhere, in my early life this powerful force was invisible to me. Like a fish in water, I swam in money energy without seeing it for myself. My work has been a journey through our modern money energy: studying it, working in it, and now for many years attempting to transform it.

My parents were in the social sector, unconcerned with money, other than the fact that some people didn’t have enough of it. My early career was connected to the study of labor, not capital. In my twenties I was a labor economist. I learned about labor exploitation from Marx, about the nature of power and institutions from John Kenneth Galbraith, and about the magic of the market from the dominant group of economists, the neoclassicals. I taught labor economics at Wellesley College, just before it became famous as Hillary Clinton’s alma mater.

The success of the neoclassicals was such that it became the dominant American economics. I will generalize, and refer to the neoclassical perspective as simply the way that economists thought. Thirty-five years ago their thinking reflected a post-war American political consensus – albeit a consensus that was in the process of breaking down.

Where does money energy fit into this equation?

In physics, energy is understood as a force allowing a system to do work, to make changes in the physical world. Money is a form of stored human energy, with tremendous power to shape human behavior. Its growth was exponential during the industrial age, and has continued to expand during our fast-evolving era of networked information. Global money shapes all that crosses its path, giving birth to the Anthropocene: the geologic era of the human.

Money moves in markets like any other commodity, with buyers and sellers, demand and supply. Yet pure money energy is unique in that it has no intrinsic value. You can’t consume money, enjoy its beauty or expect it to make you a cup of coffee. It has no use value. Like other forms of energy, we experience money through its consequences. The seemingly all-consuming power of money as a form of energy derives from its ability to harness human activity: labor, capital, whatever can be bought. In today’s world it sometimes feels like money is the only energy that informs our activity. Money mostly exists in cyberspace, not in paper and coins, and thus is about the fastest moving thing on earth. At its best, money energy lubricates the “real” economy and makes it work better. As money flies around the world at great volume and speed, its architects and practitioners take a tiny bit for themselves along the way. This large volume of bits makes for some delectable bites, enabling a relatively small number of people to get very rich.

A mercenary for money

With regard to my own personal money energy, as a young professor I was facing a common problem among the academic class: you can’t eat prestige. Teaching labor economics at Wellesley College didn’t pay well. I was financially supporting a young family and feeling money pressure. So I did the most unremarkable thing: I traded a poorly paying job I enjoyed in the non-profit sector for well-paid work in the financial sector, becoming a mercenary in the world of money itself. A mercenary for money. It ended up being a 13-year enlistment, commuting in my everyday uniform of clipped hair, ironed dress shirt, black socks, leather belt and shoes, suit and tie. Being a mercenary can be alienating and in many respects miserable, but I learned a lot about money energy from the inside. And I met my objective: at its peak my annual income was approximately 3,000% higher than what I was paid at Wellesley College.

The era of big money globalization

My mercenary period was well-timed. During the prior Cold War era money energy was strong, but it was conditioned and directed through a lens of social justice and emergent environmental awareness. Labor and government were understood to be important sources of countervailing power, limiting the scope of pure free-market money energy. When I connected to big money in the 1990s, the globalization of the world economy was in full swing, and money was going through an expansive transformation. The Cold War ended, trade barriers were falling, and unions had been decimated during the previous two decades.

With time, lessons from the 1930s about financial market regulation were forgotten. Banks were once again given the latitude to combine and speculate. Capital was trouncing labor, and wealth was getting much more concentrated at the very top. It was the adolescent phase of global big money, accelerating quickly and reaching a powerful crescendo in the financial crisis of 2007-2008. My home town of Boston was changing rapidly. The city was becoming a center for money energy with connections to New York, London, Frankfurt, Tokyo and anywhere else where globalized markets had emerged.

Playing with big money energy

I worked at Wellington Management as a global investment strategist. Wellington was an elite money manager, and our global client list ranged from the world’s largest pension plans to sultans and princes. We celebrated when the firm’s assets under management grew beyond $300 billion for the first time. Later I was recruited to London to work as the Chief Global Strategist for Deutsche Bank’s asset management group. These huge institutions now manage around $1 trillion in assets each, an almost unthinkable amount of money: a billion dollars, replicated one thousand times. In such concentrations, money energy has power. To conduct research we had access to virtually anyone, including central bankers, CEOs of the world’s largest corporations, former presidents and prime ministers. The enormous commissions we paid to Wall Street brokers for trading services motivated them to give us access to whatever we desired. Around the world we were treated like royalty, backed by billions.

It took a bit of time to learn how to handle other peoples’ money. The most important part of the job is to set the overall strategy, for example what percentage of a client’s wealth to place in riskier assets with more long-term potential, or in investments outside of their home country. Otherwise, there is scant value added by an industry that could easily be smaller and less lucrative. The continued success of the financial sector derives from its opacity and weight, from wealth and power itself. The closer you get to it the more you suspect that the emperor has no clothes. He does own a gigantic, lucrative and sophisticated casino, and he knows how to make people believe they can’t live without it.

Why did it feel so bad?

At root, my alienation was not that difficult to understand. I didn’t see the work we were doing as adding much value, even for the clients themselves. Predicting the future is ultimately impossible on a consistent basis. Even when right, it is often difficult to separate luck from skill. Most importantly: long-term financial results are largely a function of the underlying resiliency and integrity of the economic system itself. Yet there was nothing we were doing to help ensure a well-functioning system. Instead we were simply trying to do a bit better than whatever the system returned on average, ignoring ways in which the money-fueled economy was itself unsustainable. This did not feel like valuable work.

An escape to alternative money energy

I dreamed of an escape from the world of big money energy. There was not an obvious place to land. Labor, a traditional source of countervailing power, seemed helpless in the face of mobile global capital. And in the US, there was a corrupt relationship between politicians, corporations and Wall Street, subverting government’s essential role. I had learned a few things about money, but I wasn’t quite sure what to do about it. The old mechanisms to cope with income inequality, carbon pollution and other market failures were absent. Even the lessons of the Vietnam War were forgotten, as we embarked on tragic occupations of Afghanistan and Iraq that did much more harm than good.

I came back to the United States looking for alternatives. I found one, becoming the Chief Investment Officer of a money management firm in Boston. The firm’s clients wanted to channel money energy for private gain, social good and environmental sustainability, the so-called triple bottom line. This was a somewhat esoteric notion to me, very different from the economics that I had learned or the ethos of the money world from which I came. Market failures would be fewer if market actors pursued not only their financial interests, but also the long-term interests of humanity and the planet. No doubt, at the time the demand for this alternative form of investing was small, and the company I worked for was about 1/1000th the size of the large institutions I had abandoned.

I’ve now spent a dozen years in this world of purpose-driven money, and interest has grown exponentially. More people are losing confidence in the old structures and systems. The power of networks helps us better understand and manage our choices. Buying local, growing food locally, working for positive social purpose, revealing the labor and environmental footprint of the goods we buy and sell — all are evidence of a more conscious form of capitalism. From this expanded perspective the cheapest goods are really not that cheap after all. Intentional production and consumption would be growing even faster in the United States if not for the deteriorating wage structure at the bottom. Poverty and low wages drive demand for cheap, socially and environmentally problematic food and merchandise, reinforcing the status quo.

The system of money energy is the last piece of capitalism’s transformation, and the most resistant to change. The psychology of money is complicated, and fear impedes innovation. There is often a false comfort from staying within the herd, placing wealth with large, opaque, mediocre, too-big-to-fail institutions. It is a common assumption that money invested in an environmental and social context will generate lower financial returns, no matter how much evidence is presented to the contrary. Yet the financial crisis and great recession created an opening, with more interest in alternative money models. We are waking up to the harsh reality of a new gilded age, where money energy benefits the few despite the continued stress and suffering of the many. The system of the last 35 years — maximizing wealth at the top through unchecked global commerce, and then using philanthropy to partially patch up the consequences – is losing its appeal. I appreciate philanthropy, but relying on Bill Gates and Mark Zuckerburg to transform our world is a fool’s errand.

Investing can be transformed from a blinkered exercise in personal wealth building toward a more holistic assessment of how to harness the potentially positive impact of money. Thus the birth of “impact investing.” No doubt, money as a form of energy has impact. But in the world of impact investing there is an explicit accounting for the personal, social and environmental influence of money. The emerging structures enabling investment with a positive impact are much smaller than what they are replacing, which is critical to their appeal. Rather than pushing out as much investment as is possible, impact investing starts with an assessment of where positive impact lies. Not all opportunities to make money should be pursued, and few areas of positive impact will be at gigantic scale.

Good growth vs. bad growth

In a resource-constrained world of 7.3 billion people and counting, it is legitimate to ask whether further economic growth is wise. Yet money energy is growth energy. The question becomes: what should grow? Investing with intention begins with a clear understanding of the investor and what they are seeking financially, morally, ethically, spiritually. No matter how delivered, this intentionality connects the investor to their money in ways that create meaning and engagement for the investors themselves. In addition to financial outcomes, impact investing identifies additional tangible metrics of social and environmental value: expanding income and wealth at the bottom of the economic pyramid; radically increasing the supply of distributed renewable energy, growing technologies that improve energy efficiency and reduce resource use; creating jobs at living wages; nurturing an informed, educated citizenry; expanding the range of social and racial justice; supporting local living economies.

By redirecting money energy toward positive social and environmental use, there are things that will inevitably shrink: extreme income inequality, pollution, toxins, labor exploitation, disease, poverty, crime, greenhouse gas emissions, weapons of war and mass destruction. Many of these terrible things end up in GDP accounting, and shouldn’t. The old world of disconnected, harmful money energy will also shrink. Impact investing requires measures of true progress and deterioration. The redirection of money energy can only be judged successful if what is growing has a transformational positive impact on human and planetary welfare.

The Future of Money Energy

I believe that deregulated global money energy has reached a point of crisis, and that a more distributed, decentralized money architecture is being built to replace it. We are in the early stages of a great journey: money’s conscious redirection toward positive impact. Small and local is not only beautiful, but is an essential part of this emergent, resilient infrastructure. This new money energy feels better: vital, honest, connected, valuable, healing, and ultimately satisfying. New money energy is the whole food that helps rid our systems of the toxins that ail us.

In the world of impact investing we are seeing a flourishing of new types of investment structures, as well as seasoned players who are finally getting the attention they deserve. As demand picks up for alternatives, so does the supply. These new models are quite varied, ranging from community-sourced capital to peer-to-peer lending, from renewable energy finance to sustainable agriculture, from fair trade commerce to providing breakthrough services for the billions of people at the bottom of the global economic pyramid. The common thread is a transparent accounting of the social and environmental impact of these investments, documenting the positive potential of the new money energy. This is holistic investing that uses our brains, but with eyes and hearts open.

Radical new approaches to money energy are not only encouraging, but necessary to avoid the increasingly frightening possibility of a dystopian future. Interest in a more connected money energy is growing among older investors concerned about their legacy, in pension funds and other institutions that reflect the progressive nature of their constituencies, and especially among young, networked millennials itching for fundamental generational change. Having just emerged into adulthood, they will enjoy the greatest gains from positive change, and face the largest risks from societal failure.

Can money energy really be redirected and transformed? I think it can be, but only if several things happen.

Necessary changes

Understanding the limitations of free markets

Economists from Adam Smith to the neoclassicals have celebrated the magic of free markets. Yet when I was a graduate student much of the work of economists grappled with market failures, not successes. Failures of poverty and income distribution, of associated maladies such as crime, depression and poor health. Failures of pollution and environmental degradation. Failures of monopoly, oligopoly, and of excessive concentrations of industry power. These were often labeled “externalities”: unfortunate leakages from an otherwise closed, elegant, competitive system. Indeed, the market ideal was sanctified as “perfect competition.” The solutions to the external leakages from this perfection invariably involved some sort of government intervention.

Despite these market failures, economists loved then, and continue to love, private markets: the elegant way that buying and selling sets prices, organizing workers, raw materials, buildings and machines into productive use. The modern world was built by the power of markets, supported by the rule of law, science, industrialization and trade.

Creating the right infrastructure around money

The economists were right: markets can’t solve all problems, and market failures must be recognized and addressed. Impact investing risks being a utopian project if it is not conditioned and supported by effective public policy. The US needs to join all other major nations by underwriting a baseline of progressive taxation, living wages, affordable universal health care and secure housing. Basic research on renewable energy and disease prevention, as well as investments in energy-efficient public transportation are areas where public impact investments are sorely needed. “Too big to fail” institutions must be broken up, decreasing their political and market power, and reducing socialized risks. Money energy must no longer be allowed to corrupt and distort politics. And we must join the world in setting an honest environmental price on greenhouse gas emissions. Given our history and current challenges, we must do these things through the lens of racial and economic justice. I am encouraged that these necessary changes are at least being discussed during the current political cycle in the United States.

Redirecting the old money energy into the new

Finally, the system cannot and will not reform itself from within. As interest in impact investing grows, it is becoming the next business line in mega-financial companies. Goldman Sachs just bought a leading provider of impact investing research. The firm Mitt Romney founded, Bain Capital, is starting an impact investing fund. These are reactive attempts to co-opt the next big thing, with little influence on an oligopolistic, lucrative superstructure. I seriously doubt that the infection will transform the host. We need to keep nurturing and growing authentic alternatives from outside the broken but still-dominant money infrastructure.

Information technology is helping move us away from large, risky, concentrated systems toward distributed, resilient infrastructures. Gigantism leads to excessive pay and power. Finance is considered scalable, but how many large institutions are excellent in all respects? On a number of dimensions, the small, focused mission-driven money management organization I co-founded is higher-performing than the behemoths I abandoned. Size, after a point, is a detriment to the client, but it helps make the money handlers excessively rich.

New money principles

There are almost 300 global asset owners who have signed on to the UN Principles for Responsible Investment (PRI), representing $59 trillion in assets. They range from the Norwegian Government Pension Fund to the New York City Employees Retirement System. They have committed to six principles, and have demanded that their money managers do the same. The commitments boil down to investing with a broader lens, and accepting that environmental, social and corporate governance factors can have an important impact on financial returns. While better than nothing, this is an extremely narrow perspective on responsible investing.

Imagine if those in charge of these truly massive pools of money agreed to several new principles: we will understand the pay structures of our money managers, and how they contribute to social injustice. We will seek out smaller institutions, and we will have a bias toward local money managers. We will set a goal that the ownership and employment structures of our money managers reflect the racial, ethnic and gender mix of our home country workforce.

In the United States, it would currently take the average household about 20 years to earn $1 million dollars. Some money managers make in one year what the average worker makes in 100 or 1,000 years. Please take it from me: managing other people’s money is not worth 1,000x what people around you on average earn themselves.

Change is suffering, and if money energy is transformed there will be a global howl from Boston, New York, London and Frankfurt. And then we would enjoy multiple beneficial effects. The world of money would become smaller and more localized. It would be more diverse economically, racially and by gender, and thus inevitably more socially progressive. Money managers would become cheerleaders for impact investing. And some of the privileged and talented college graduates now tempted by the world of big money would find more productive uses for their time. Most importantly, the aggregate outcomes from the financial sector, measured holistically, would dramatically improve. Socially just, environmentally sustainable and decentralized market systems reduce risk, creating the best long-term financial returns, minimizing market failures.

Money that feels better, works better

I now am one of the three founding partners of Arjuna Capital. We manage wealth for individuals, families, family foundations and the non-profit sector. For us and I believe for our clients, the new money energy feels better, because it actually focuses on what is important: synching money with our best selves, helping solve our essential interconnected problems as opposed to making them worse.

At my firm our clients’ ownership of stock empowers us to engage large corporations in dialogue. Each of these engagements speaks to the long-term interests of the shareowner — not in beating the market, but inimproving the performance of the market itself. We have engaged companies on the risks of stranded carbon assets that scientists tell us cannot be burned, on the productivity benefits of gender pay parity in the technology industry, and on the social and economic case for open, equal access to the internet. The owners of private corporations include a large number of small shareholders, and through the power of networks the mass of investors can have a seat at the money table. Democratized owners are also engaged citizens, voters and family members. Their interests expand well beyond the short-term movement of share prices.

The new money energy is more distributed, networked and democratic than what it is replacing. At its best, both public and private investing imagines a better future, channeling today’s savings into tomorrow’s possibilities. Money’s redirected energy will expand its reach only if it authentically connects into larger social movements, promoting distributed civic participation, environmental health, and economic and racial justice. It does not stand apart from these movements, but is rather their monetary arm. Impact investments can provide an attractive return to the investor. One can often see more clearly through a broader lens. To be successful on its own terms, the new money energy must replace what came before it, improving system resiliency and performance, connecting us to our deepest values and our local communities, working for all of humanity, broadening our circle of care, healing the world, and protecting it for generations to come.

Acknowledgements: Each of these five people is my brilliant colleague, my trusted partner, my dear friend. All provided helpful comments on earlier drafts. Christina Rappich, Eric Poettschacher, Farnum Brown, Jane Settree-Seitchik, Natasha Lamb: thank you, with blessings of gratitude. – Adam

Adam Seitchik is the Chief Investment Officer of Arjuna Capital. Their investment professionals are widely regarded as some of the most experienced and skilled analysts in the entire field of sustainable and responsible investing, particularly when it comes to the burgeoning discipline of ESG (environmental, social and governance) risk and opportunity analysis.

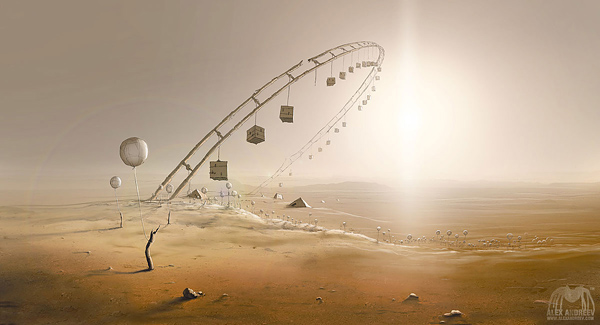

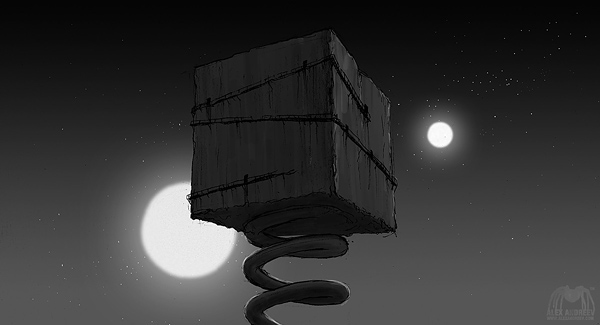

Alex Andreev lives in St. Petersburg and has been drawing, painting and doing graphic design over the last 20 years. He works as art director in an advertising agency and as senior concept artist for movies and game production. His work can be purchased online at UGallery.